Boston Consulting Group Perspective

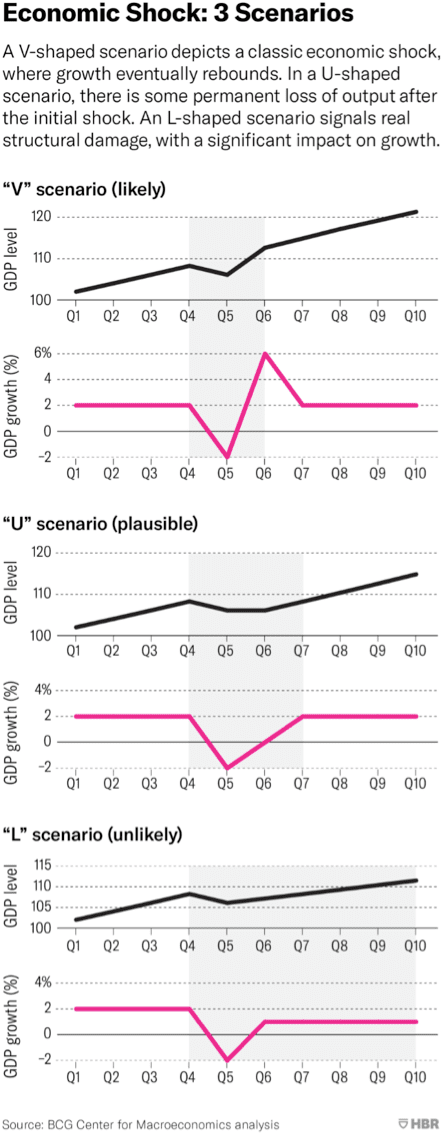

It is worth understanding how financial markets and economies typically respond to economic shocks. The charting of markets over the course of time where an economic shock has occurred usually takes one of three forms “V”, “U” and “L”.

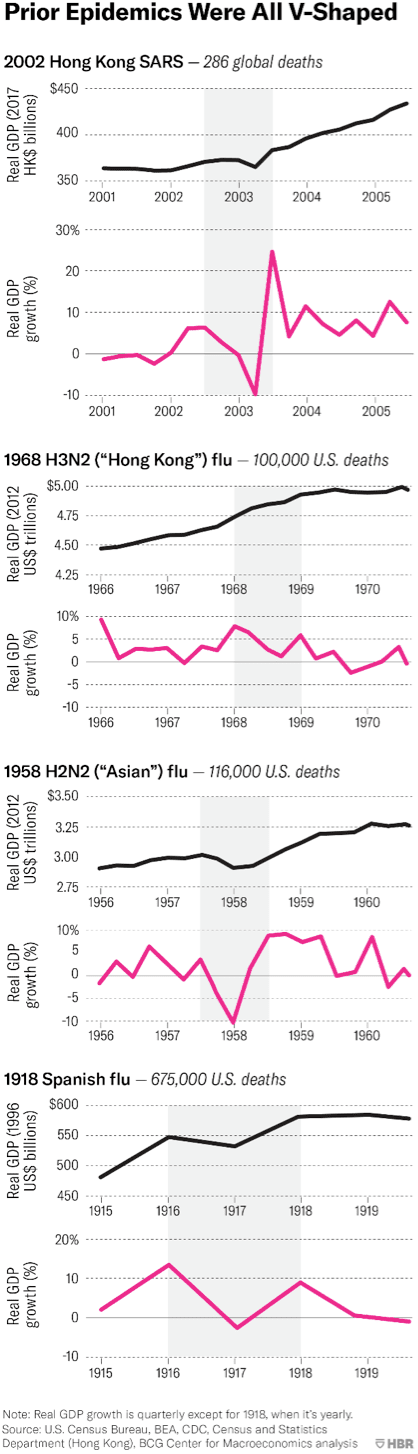

History says that health epidemics will typically follow a “V” shape which tends to indicate a 6-12-month period of decline followed by a recovery. It is also possible however given the significant emotive response to this event that a “U” scenario may occur, where the recovery is in fact a longer term (1-3 year proposition) where after the current drop in the market, whilst the virus is priced in, the road to growth is longer and thus markets remain flat for a greater period, noting that low growth is typically exhibited for longer periods rather than a relatively quick rebound.

Recessions in the 1950’s and 1970’s were consistent with this pattern of recovery. The 1950’s was driven by miscalculation of monetary policy by the US Federal Reserve (and the associated fiscal response from the US government). In the 1970’s a combination of the impeachment of Richard Nixon and the 1973 OPEC embargo was the leading cause.

It is reasonable with these historical comparisons to draw the view that COVID-19 in and of itself is more likely to result in a V shaped recovery as with other health crises, however per Ray Dalio’s commentary and the historical impact of other external factors that we are seeing emerge at the moment (emergency fiscal and monetary policy, instability in global oil prices) if factors such as these hinder rather than help recovery, a longer timeframe becomes more and more likely.

Prior pandemics all followed a “V-shape” per below but given the extent of the public apprehension surrounding this pandemic, other scenarios appear equally plausible.